Subscribe to this newsletter now and hop on over to Drift’s YouTube channel and subscribe to us there as well! We’ll be sharing free trading alpha each week and - trust me - you don’t want to miss out.

For this second edition of our weekly newsletter, we will cover Solana ($SOL) and Polkadot ($DOT). While Bitcoin is not showing signs of recovery and continues its downtrend on both Low Timeframe (LTF) and High Timeframe (HTF), we’ll determine whether its habit of taking the whole market down with it applies to current price action on $DOT and $SOL.

I. Polkadot Market Review

$DOT is now available to trade as a perpetual swap on Solana via Drift Protocol, a lightning-fast and scalable perpetual futures DEX. This is the only DEX now offering $DOT for trading on Solana, with the possibility of using 5x leverage.

Figure 1. DOT HTF Key Levels

Looking at the Monthly, a Swing Failure Pattern is evident after May’s high got taken out by a new ATH early November. However, we see that DOT has been in a downtrend for over 2 months now and can attempt to define a HTF range using the Volume Profile, with Value Area Low (VAL) at $23.79, Value Area High (VAH) at $43.92 and Point of Control (POC) at $27.95.

As you can see, executed volume decreases significantly below VAL and these gaps on volume constitute Low Volume Nodes (LVN). LVN edges (in this case, VAL) act as support or resistance depending on context. Therefore, we can consider that DOT is currently sitting at HTF support.

Figure 2. DOT 1D Key Levels

On the daily timeframe, range high & low are clearly defined while the price action recently rejected the Point of Control (level of highest executed volume within the range). There are presently 3 likely scenarios that come to mind:

Price comes back to the range low and bounce from there, creating a long opportunity and targeting the POC again or the range high;

Some kind of Wyckoff spring happens: a move going below range low on high volume, trapping shorts and reclaiming range low again for a long entry;

Price breaks down below support and re-test it for a short entry, goes through the first LVN and find some temporary relief at $20.5, which is the next support.

What is not debatable is that the market structure is not bullish and that our bias should only shift if we break the range high in a clean fashion. Do note that price experienced a -59.5% drawdown since early November so highly leveraged shorts might not be the best instruments to use at the moment, as we may be closer to the bottom than the top. Starting Dollar Cost Averaging (DCA) here on spot is definitely not a bad idea considering the discount available, but the price being stuck between range low and POC does not warrant any kind of leverage swing longs.

In conclusion, it is wise to wait for price to reach range low and identify which of the 3 possibilities above unravels when it does.

Figure 3. DOT 30 mins indicators status

On the LTF, such as 30 mins or lower, hardly anything stands out as bullish as we can only observe successive lower highs and lower lows with no clear sign of absorption or exhaustion on oscillators or OBV (On-Balance Volume). Absorption is typically happening when the indicators are printing a lower low while the price action shows a higher low, while exhaustion is a higher low on the indicators and lower low on the price action. When this occurs, it creates opportunities for intraday trading and possibly signs of HTF recovery, with the latter requiring confirmation such as reclaim of a HTF level.

II. Solana Market Review

Figure 4. SOL 1W Technical Analysis

SOL experienced a -50%+ fall since early November highs and is now located at the edge of a HTF LVN, which acts as support. It’s important to note that it’s also trading below yearly VWAP, implying that Solana just entered undervalued territory. Whether it’ll stay there for a long time remains to be seen.

With the market structure being bearish, we must assume that the LVNs (market inefficiencies) have a good potential to get revisited with a close above yearly VWAP being the invalidation of that idea.

Figure 5. SOL 1D Technical Analysis

One thing that we notice across the board is a clear reduction on trading volume on the main CEXs, providing a hint that sellers are showing signs of exhaustion. That being said, half the work is done and without buyers bidding, it’ll be difficult to revert any kind of HTF trend.

Figure 6. SOL 1D Market Structure

With the market structure being quite messy on lower timeframe, we could potentially re-evaluate our bias if we print a higher low above $130.79, break the $157.38 level and print another higher low above $130.79. Until then, it’s very difficult to qualify any swing long on the daily TF. In addition, we’re at a stage where the crypto industry is struggling to innovate, so the arrival of new fundamental catalysts would be welcome to drive buying volume.

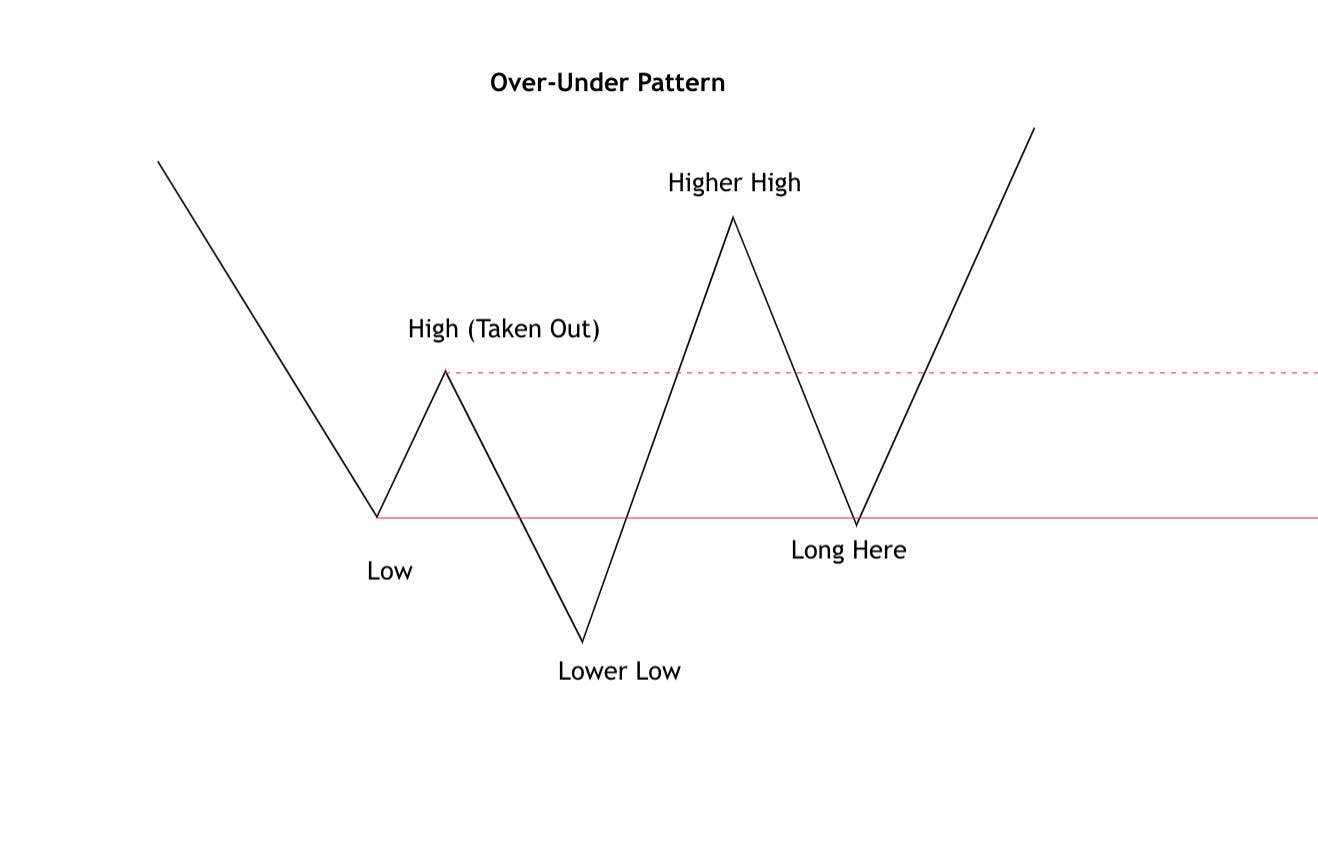

Figure 7. SOL 4H Possible Over-Under Pattern

One thing that comes to mind when looking at the 4H is the potential unfolding of an over-under, which a reversal pattern and involves longing at a former higher low with a stop-loss below previous lower low, providing that the high printed between the higher low and lower low is taken out.

Figure 8. The Over-Under Pattern

This is something that we covered in our first educational video, so please check it out if you haven’t yet!

III. Conclusion

On the HTF, both Solana and Polkadot reached support, with very shy reactions exhibited so far. While HTF and LTF market structure is undoubtedly bearish, the absence of volume could signify that sellers are getting exhausted, but we would need bulls to confirm that a HTF bottom is in by:

Stepping in with high volume;

Reclaiming significant HTF levels.

In the meantime, any type of swing position is definitely not recommended as we must remember that both tokens are down over 50%. There are opportunities on the lower TF by playing within the current ranges or identifying patterns such as the over-under, but remember to take profit on those trades and not get complacent because the market tends to be chopping many traders at the moment.

🚨🚨 We are hiring 🚨🚨

Get in touch with us via email if any of the below roles suit you.

Product Designer

Head of Community

Frontend Engineer (Mobile)

Smart Contract Engineer

Full Stack Engineer

View full list of available roles at Drift Protocol here.

Get in Touch!

🌐 Visit us at drift.trade 🌐

📩 Email us at hello@drift.trade 📩

💬 Connect with us on Discord 💬

👾 Find us on Twitter — @DriftProtocol 👾

🧵 Read about us on Medium🧵

📺 Catch us on Youtube 📺