Subscribe to this newsletter now and hop on over to Drift’s YouTube channel and subscribe to us there as well! We’ll be sharing free trading alpha each week and - trust me - you don’t want to miss out.

Welcome to this first edition of our Drift Education series on $BTC and $ATOM.

Following extremely volatile days since early November 2021, we will evaluate the current status of the market through the lens of Bitcoin and will have a dedicated section to currently-popular IBC token, ATOM.

I. Bitcoin Market Review

The past couple of months have been pretty rough for holders as BTC experienced a -42.5% pullback since its all-time high (ATH). Most of alts suffered from even deeper corrections, which is creating interesting opportunities when it comes to buying spot for long-term positions.

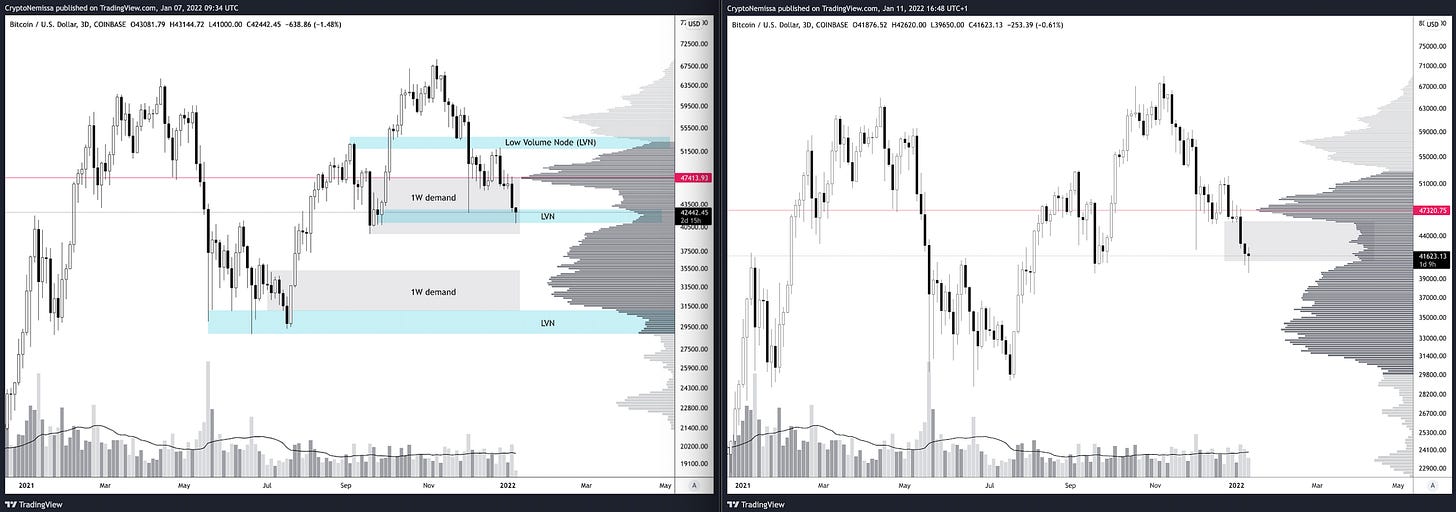

Figure 1. BTC Higher Time Frame (HTF) Key Levels

Structurally speaking, BTC is now sitting at weekly demand and we have yet to observe a significant reaction from it, e.g. a reclaim of 45.5k or even better, a close above the 47.3k Point of Control (in red on the chart). That being said, moves from HTF levels take significantly more time than on lower timeframe so we must exercise some patience before adding some more bear fuel on the fire.

Trading close to a High Volume Node (HVN) edge, as outlined in green on the chart, deliver additional confluence that the current level is attractive for buyers, as edges typically offer reactions since they act as support or resistance. It essentially means that we’re trading below former fair value at 47.3k and that sellers may not be inclined to sell anymore.

Furthermore, a Low Volume Node (LVN) was previously located above the HVN and got filled by recent price action. LVN are areas of low volume distribution, represented on the Y-axis (price). Here are the charts before/after LVN fill:

Figure 2. BTC before and after LVN fill

Seeing the market distributing time & volume at inefficient areas is a healthy sign as it’s actually doing what it’s supposed to do (facilitate trades between buyers & sellers at high volume for a prolonged period of time). Now that this inefficiency is fixed, it remains to be seen whether a reversal is in order.

Regardless, any swing trade opportunity should be conditioned by a break of market structure (aggressive entry: reclaim of 45.5k; safer entry: reclaim of 45.5k + break of previous swing high at 52.1k).

Figure 3. BTC 4H Market Structure

On the 4H the market structure is undoubtedly bearish with successive lower lows (LL) and lower highs (LH) printed. Price is now stuck within a well-defined range with previous lows being taken out and price hugging the range high resistance. Bear in mind that a LVN is sitting right above the range and the the probability of seeing a swift move to previous lower low is high if we see a clean break of the range. Consequently, breakout trades (careful with fakeouts) are preferred since BTC tends to avoid providing re-test opportunities in similar situations.

Venturing into swing shorts does not provide the best R:R here, unless we see a relief rally through the LVN with rejection by the previous lower low. On lower timeframe, failure to break range high will offer a short opportunity to the middle or the range low.

As regards to futures data, the Open Interest is currently at $13.9 Bn, which is roughly $8.5 Bn lower than at ATH and while the aggregated funding rate is currently positive, it is not overheated yet.

II. Cosmos (ATOM) Market Review

Figure 4. ATOM-PERP trading on Drift is now live

ATOM is now available to trade as a perpetual swap on Solana via Drift Protocol, a lightning-fast and scalable perpetual futures DEX. This is the only DEX now offering ATOM for trading on Solana, with the possibility of using 5x leverage.

Figure 5. ATOM 1W Market Structure

In addition to being bullish, the weekly market structure of ATOM is very clean, with previous inefficiencies filled and followed by a push to ATH. A strong reaction from weekly demand led to an attempt to take out ATH, for now rejected. As a result, the close of the current weekly candle will be decisive to gauge whether ATOM will continue upwards to new highs or pullback again towards weekly demand.

Figure 6. ATOM 3D Key Levels

With price now trading above the POC shortly after breaking a 3D key level, it is undeniable that ATOM is exhibiting clear signs of strength. With that said, we must be on the lookout for potential HTF Swing Failure Patterns that BTC made famous back in November by taking previous ATH and reversing the trend.

With modularity & the IBC narratives being at the forefront of 2022, the Cosmos community is expecting a significant growth in the utilisation of the ecosystem across the board. These excellent fundamentals coupled with strong technicals are catalysts for a re-pricing of ATOM that definitely should not be overlooked.

Figure 7. ATOM 4H Overview

On the 4H, ATOM swept January 8th & 9th lows followed by a break of market structure and creation of a nice entry for a swing long.

At this stage, a slow grind towards the highs is preferable as opposed to impulsive moves. As efficient price action leads to inefficiencies and vice-versa, we would rather see an impulse near resistance with a clean close above, as an insurance that price action will indeed enter uncharted territory.

As a final note, an efficient volume distribution represented on the Volume Profile is another factor that can lead the market to start showing some signs of imbalance on the HTF as we get closer to resistance.

III. Conclusion

Bitcoin is now sitting at HTF demand with a HVN edge providing confluence for potential relief on the upside following a -42.5% move since early November. Reclaiming $45,500 is best to initiate any type of swing longs and waiting for a 4H shift in market structure would enable lower time frame (LTF) long opportunities. It may too late to short but a pullback close to 45,500 and failure to break above would be a trigger to consider.

While resistance is only a few percent away, ATOM benefits from bullish market structure on both higher and lower timeframe. Moreover, the stars are aligned as not only the technicals are showing clear signs of strength but solid fundamentals are also a catalyst to propel the top IBC token to a new ATH.

🚨🚨 We are hiring 🚨🚨

Get in touch with us via email if any of the below roles suit you.

Frontend Engineer (Mobile)

Smart Contract Engineer

Full Stack Engineer

View full list of available roles at Drift Protocol here.

Get in Touch!

🌐 Visit us at drift.trade 🌐

📩 Email us at hello@drift.trade 📩

💬 Connect with us on Discord 💬

👾 Find us on Twitter — @DriftProtocol 👾

📺 Catch us on Youtube 📺